Open Finance Adoption & Multi-Banking Strategy

Understanding the multi-banking landscape and quantifying Open Finance adoption opportunities

The Story

Here's a surprising finding: 73.89% of customers said Nubank is their favorite bank. But only 50.49% actually use it as their primary account. That's a 23.5 percentage point gap—representing over 10 million customers who love Nubank but keep their main financial life elsewhere.

Why? The answer lies in understanding multi-banking behavior. Most people don't just have one bank—they have an average of 2.7 accounts, each serving a specific purpose. One for salary, one for investments, one for daily spending, one for better credit limits.

The question was: How can Open Finance help us become that primary account? To answer this, we needed to understand not just what people do, but why they do it—and what would make them change.

The Challenge

Why do customers use multiple banks, and how can Open Finance help Nubank become their primary account? We needed to understand multi-banking behaviors, primary account drivers, and Open Finance perception across 24+ million customers.

Research Objectives

- Validate drivers for maintaining multiple bank accounts (organization, security, specific roles)

- Quantify factors driving Primary Bank Account choice (experience, convenience, benefits)

- Measure Open Finance understanding and perceived benefits across customer segments

- Identify security concerns regarding data sharing and privacy across different user groups

Research Methodology

Quantitative Survey Design

Large-scale survey targeting Nubank customers who made at least 2 self-transfers of R$10+ to Nubank from external accounts in the last 30 days (August 2025).

Total respondents

99% confidence, 3% margin of error

Confidence level

46% see Nubank as leader

Margin of error

Representative findings

Sample Selection

Customers who actively transfer money between accounts, indicating multi-banking behavior and potential for Open Finance adoption

Statistical Rigor

99% confidence level with 3% margin of error ensures findings are representative and actionable for strategic decisions

Three Distinct Customer Profiles

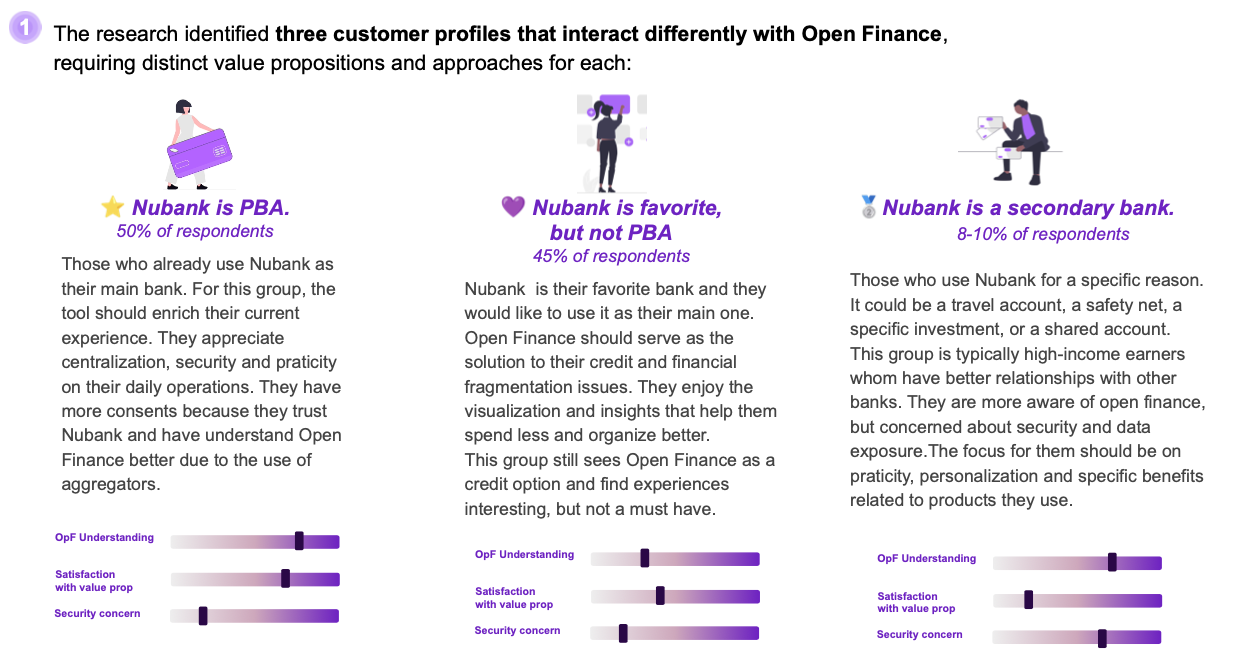

The research identified three customer groups that interact differently with Open Finance, each requiring distinct value propositions:

Nubank is PBA

Customers who already use Nubank as their main bank account, handling most daily transactions

Key Characteristics:

- •Value centralization and integrated financial services

- •Appreciate security features and convenience

- •Seek practicality in their daily operations

Open Finance Relationship:

Better understanding of Open Finance due to active use of aggregators; show higher consent rates due to established trust with Nubank

Nubank is favorite, but not PBA

Customers who prefer Nubank but use another bank as their primary account

Key Characteristics:

- •Enjoy visualization tools and financial insights

- •Want better organization and spending tracking

- •View Open Finance as a credit opportunity

Open Finance Relationship:

Open Finance should serve as the solution to their credit fragmentation issues; find experiences interesting but not must-have

Nubank is secondary

Customers who use Nubank for a specific purpose rather than as a main account

Key Characteristics:

- •Typically higher-income earners

- •Use Nubank for specific services (travel, shared expenses)

- •Better relationships with other institutions

Open Finance Relationship:

More aware of Open Finance but concerned about security; focus on practicality, personalization and specific benefits

Why People Use Multiple Banks

Average number of bank accounts actively maintained per customer, each serving a specific financial purpose or need

Bank Roles in Customer Lives

Nubank

54.4%Daily payments and transactions

Bradesco/BB/Itaú/CEF

32-38%Salary accounts and benefits

Mercado Pago

31.6%Online shopping and entertainment

XP Inc/BTG

44.7%/27.2%Investments and wealth management

Pan/Sicoob/CEF

29.5%/16.7%Financing and loans

Key Insight

Customers intentionally maintain multiple banking relationships to maximize benefits and distribute financial activities strategically—not due to indecision or dissatisfaction. This is deliberate financial organization.

Three Customer Behavior Types

Deal Hunters

Seek the best offers and benefits, optimizing rewards across institutions. They use specific cards for targeted perks rather than for daily use.

Financially Strapped

Need multiple accounts to secure essential credit and organize spending in categories. They perform "financial juggling" across institutions.

Wealth Managers

Seek efficiency and security across various financial products. More interested in automated payments, transfers, and centralizing money management.

Credit Card Behavior Insights

Cards owned → Cards used daily

Users maintain multiple cards but actively use fewer in their daily routine, indicating strategic card usage patterns

Nubank preference for centralization

Customers want to centralize card management at Nubank, but prefer the institution offering the highest credit limit

Key Barriers & Opportunities

Credit limit availability is the main barrier preventing Nubank from becoming customers' Primary Bank Account.

- •When asked about characteristics of their ideal card centralization hub, highest available limit was mentioned more frequently than interface quality

- •Balances consolidated in one view was selected by only 4.6% of respondents as a motive for centralization

Research Insights

Strategic Impact

Strategic insights that shaped Open Finance roadmap for 24+ million customers, helping define how to convert 10+ million users who love Nubank but don't use it as their primary account.

Survey respondents

99% confidence, 3% margin of error

Users heard of Open Finance

46% see Nubank as leader

Gap: favorite vs main account

Untapped conversion potential

Key Takeaways

Open Finance adoption requires a deep understanding of customer needs and behaviors. By focusing on centralization, security, and credit limit opportunities, Nubank can bridge the gap between being a favorite bank and becoming the primary account for millions of customers.

Continuous research and innovation are crucial to address customer concerns and leverage Open Finance's potential for strategic growth.